- What’s a 1% deposit home loan?

- Benefits and drawbacks

- The way to get a 1% deposit financial

- Selection

Associate website links with the affairs in this article are from lovers one to make up united states (discover our marketer revelation with our range of people for much more details). Although not, the opinions was our very own. Observe i price mortgages to enter objective ratings.

However, once the to order a house only has obtained reduced affordable from inside the the past few years – and mortgage rates enjoys soared, lenders experienced to locate imaginative to help you expand the pond away from prospective consumers.

The fresh step 1% off mortgage is one of these creative procedures. While the name implies, allowing consumers go into a house with only 1% of your price and certainly will create homeownership much more obtainable to possess of many.

But before make use of that (or go looking for 1), you should understand how this type of mortgages performs and you may whether they generate feel to your requirements and you will upcoming preparations. Here is what you should know.

Normally, a low down-payment you can make to the a normal financial is actually step 3%. Some bodies-recognized mortgage loans ensure it is no down payment, but these fund are only available to consumers who meet particular eligibility standards (such americash loans Ellicott as for example are an army user otherwise experienced, such as).

A 1% off financial try a loan enabling you to definitely make an effective downpayment away from simply 1% of your own home’s cost. So, in case your domestic can cost you $3 hundred,000, your advance payment would be simply $3,000. That is plenty of deals compared to antique step 3% you want (who amount to an excellent $9,000 advance payment)

Conventional mortgage

Most 1% down mortgages are traditional financing, being funds backed by Federal national mortgage association and you may Freddie Mac. Officially, these types of want good 3% lowest deposit, so when a lender also provides a 1% deposit antique mortgage, they are also giving so you’re able to base the balance into the leftover dos%.

About a lot more than analogy, that’d suggest might spend $step three,000 of one’s down-payment, along with your financial do safeguards the remainder $6,000.

Recommendations programs

Specific step one% deposit mortgage loans are supplied due to special area software or loan providers offering downpayment guidelines. With our, the application form otherwise lender even offers a give into the left 2% of your own down-payment or, in the example of lenders, will bring loans towards the your own closing costs and come up with up in their eyes.

A 1% down-payment financial is sound quite nice, however, discover downsides too. Here you will find the pros and cons to consider prior to taking one to of these fund away.

Pros

- Straight down burden to help you entryway: If for example the mortgage need just 1% off, you’ll be able to save money to view property. This might together with free up more funds move for the home and you can convenience monetary be concerned.

- Shorter homeownership: You will not need purchase as many decades saving right up whenever you need just 1% off. This may allows you to buy property much prior to when requested.

- Prospect of admiration: When you get towards property earlier, you may have more hours to construct guarantee to check out financial gain out of your home’s like.

Downsides

- High interest rates: Since you reduce financial facial skin on the online game, 1% off mortgage loans was a bit riskier than simply money with big down payments. Loan providers could possibly get compensate for it that have highest rates.

- Personal mortgage insurance rates: Possible constantly need to pay to have personal home loan insurance rates (PMI) once you make a small advance payment. Which develops your own payment.

- Limited lender possibilities: Few lenders give step one% down mortgage loans. You can even only have several people to choose from.

Thought a-1% down payment financial will be the right path to homeownership? Here’s how purchasing property having step one% down.

Select a playing lender

Lookup mortgage lenders, and look having banks and you can credit unions close by. Few financial institutions provide these, so you may need certainly to consult specialization lenders otherwise on the web financial companies for possibilities. Be sure to ask about first-time homebuyer programs, too, as these often have reduce payment conditions.

See qualification criteria

Once you get a hold of a lender, make sure the fresh new qualifying conditions you’ll need to fulfill. Such includes the very least credit rating, a maximum financial obligation-to-income ratio, and you will an optimum mortgage-to-well worth proportion.

Speak about guidance programs

You may want to explore guidance software that offer grants or loans that can help along with your downpayment demands. Speaking of usually considering due to regional houses divisions otherwise neighborhood communities.

If not be eligible for one of these 1% down mortgages otherwise are not yes they have been the best fit for your, there are lots of almost every other reasonable options that come with low if any down money.

FHA fund

Discover low-down commission mortgage loans supported by the latest Government Property Government. They need a down payment out-of merely step 3.5% and you will feature reduced stringent borrowing from the bank standards, including the absolute minimum credit score out-of only 580.

Va fund

These types of mortgages try backed by new Service regarding Veterans Points and you may are around for most recent servicemembers and you will experts which fulfill minimum services standards. Needed zero down-payment no financial insurance coverage.

USDA finance

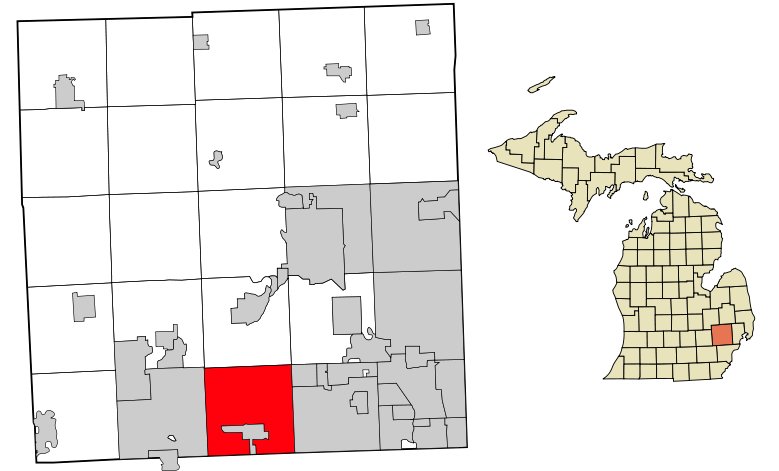

These are mortgage loans guaranteed of the Agency out of Agriculture. It permit reasonable-to-middle class individuals inside qualified rural otherwise suburban areas to invest in property with no currency down. You can make use of new USDA’s qualification map to see if you happen to be from inside the a specified “rural” urban area.

Whether or not a-1% downpayment mortgage makes sense depends on your own personal facts. Into the one hand, you should buy on homeownership reduced and begin building collateral before. Toward drawback, though, you will likely spend highest financial cost and can add individual financial insurance coverage (PMI) into monthly payments.

More often than not, PMI is necessary with a-1% down-payment, but some lenders can offer possibilities or lender-repaid home loan insurance. Should you choose owe PMI, it is possible to shell out it as section of your monthly payment until you arrived at about 20% equity of your property. At that point, you could get hold of your servicer to help you terminate PMI.

The risks of a-1% down-payment become higher rates of interest and a more impressive payment per month, because you will most likely have to have individual mortgage insurance coverage.